Tax Implications for International Property Owners

Owning property outside your country brings tax complexities that span income reporting, capital gains, withholding requirements, and local compliance. International property owners must understand how jurisdictional rules interact with residency status, double taxation treaties, and local filing obligations to manage liability and maintain compliance. This overview outlines common tax categories and practical steps to consider when holding real property abroad.

Owning property in another country introduces multiple tax layers that can affect cash flow, return on investment, and legal obligations. Beyond purchase costs and ongoing maintenance, taxes on rental income, capital gains at sale, property taxes, and transfer duties can differ widely. Your residency status, bilateral tax treaties, and local definitions of income and property value all influence tax treatment. Professional local advice and clear recordkeeping are essential to navigate reporting and avoid unexpected liabilities.

How does housing taxation differ for foreign owners?

Tax treatment of housing owned by nonresidents varies by country. Some jurisdictions tax income derived from property held by foreigners at source, while others levy property taxes or annual wealth taxes irrespective of income. Residency rules determine which global or territorial income is taxable; nonresidents often face taxation limited to income sourced in that country. Understanding local exemptions, primary-residence reliefs, or imputed rental value rules is important, as these can materially change tax obligations and effective ownership costs.

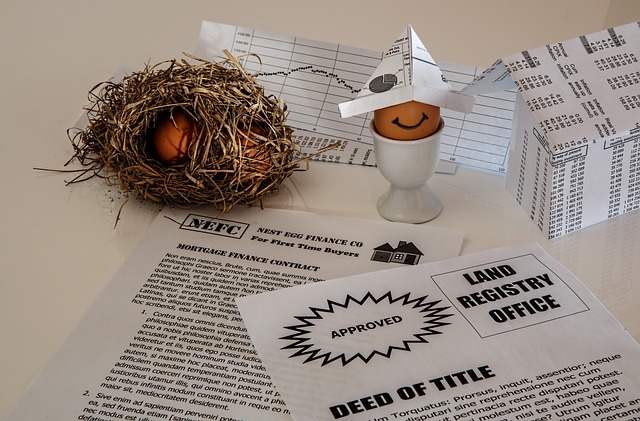

What mortgage tax considerations apply?

Mortgage interest deductibility, stamp duties, and registration taxes can affect the after-tax cost of financing foreign property. In many countries, mortgage interest on rental properties is deductible against rental income, while interest on owner-occupied housing may have limited or no deductibility. Lenders may also impose withholding or reporting requirements for foreign borrowers. When borrowing in a foreign currency, exchange gains or losses linked to the debt may have tax implications depending on local rules and on whether the property is held personally or via an entity.

How are investment properties taxed internationally?

Investment properties typically generate taxable rental income and may be subject to withholding at source for nonresident owners. Expenses directly related to generating rental income—management fees, repairs, insurance—are often deductible, but rules differ on allowed timing and capitalization. On disposition, capital gains tax often applies and rates can vary by holding period and residency. Double taxation treaties can reduce or eliminate duplicate taxation, but treaty benefits frequently require timely filings and specific documentation.

How do valuation and appraisal affect taxes?

Accurate valuation and professional appraisals influence periodic property tax assessments, transfer taxes on sale, and the calculation of capital gains. Tax authorities may use assessed values or market valuations when determining liabilities; discrepancies can lead to disputes or reassessments. For income tax, depreciation or amortization bases are typically set using acquisition cost and may be impacted by appraisal-determined fair value adjustments in corporate or trust structures. Maintain contemporaneous appraisal records to support tax positions.

How can zoning and development change tax exposure?

Zoning classification and permitted development can alter a property’s tax profile. Rezoning for commercial use or approvals to develop land often triggers reassessments, change-of-use taxes, or development levies. Incentives or tax credits for regeneration or sustainable development may be available in some jurisdictions, while speculative development can attract higher tax rates or special levies. Early engagement with local planning and tax advisors helps anticipate tax consequences of changes in land use or new development activity.

What taxes apply to rentals, leasing, and renovation?

Rental and leasing income is generally taxable where the property is located, and landlords must often register for local tax numbers and file periodic returns. Withholding tax on gross rental receipts is used in some countries for nonresidents. Renovation costs can be deductible as repairs or capitalized as improvements; classification affects current versus future tax relief. VAT or sales taxes might apply to certain services or materials. Accurate invoicing and separating operating expenses from capital improvements are essential for correct tax treatment.

Conclusion Tax obligations for international property owners are shaped by a combination of local rules, residency status, financing arrangements, and the intended use of the property. Key areas to monitor include reporting requirements for rental income, allowable deductions, treatment of capital gains, valuation methods used by tax authorities, and how zoning or development activity may trigger reassessment. Given variation across jurisdictions and the interaction with international tax treaties, seek local tax expertise and maintain organized records to ensure compliance and to make informed ownership decisions.